Don’t forget to register for the 3Q22 Index call next Thursday. We’ll be reviewing the third quarter results and diving deeper into IT services demand and the factors impacting provider profitability. Register for the call here.

If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

2022: KEY THEMES THROUGH THE THIRD QUARTER

Unprecedented levels of demand and disruptions in the talent supply chain have been the key themes for the IT services sector through the first three quarters of the year.

Background: Last week at our annual client and provider events, we discussed the changes in the sector this year. Strong demand, combined with high attrition, have impacted enterprise buyers and service providers in different ways.

Providers have been hiring at historic levels to meet demand, but attrition has also reached levels never seen before. This has been creating project and transition delays for enterprises at the exact moment they need to accelerate their technology modernization.

And, despite the combination of strong demand and a constrained talent supply chain, prices show a mixed trend. Rates for project work are increasing, but the highly competitive nature of managed services means providers have limited pricing power.

The Details:

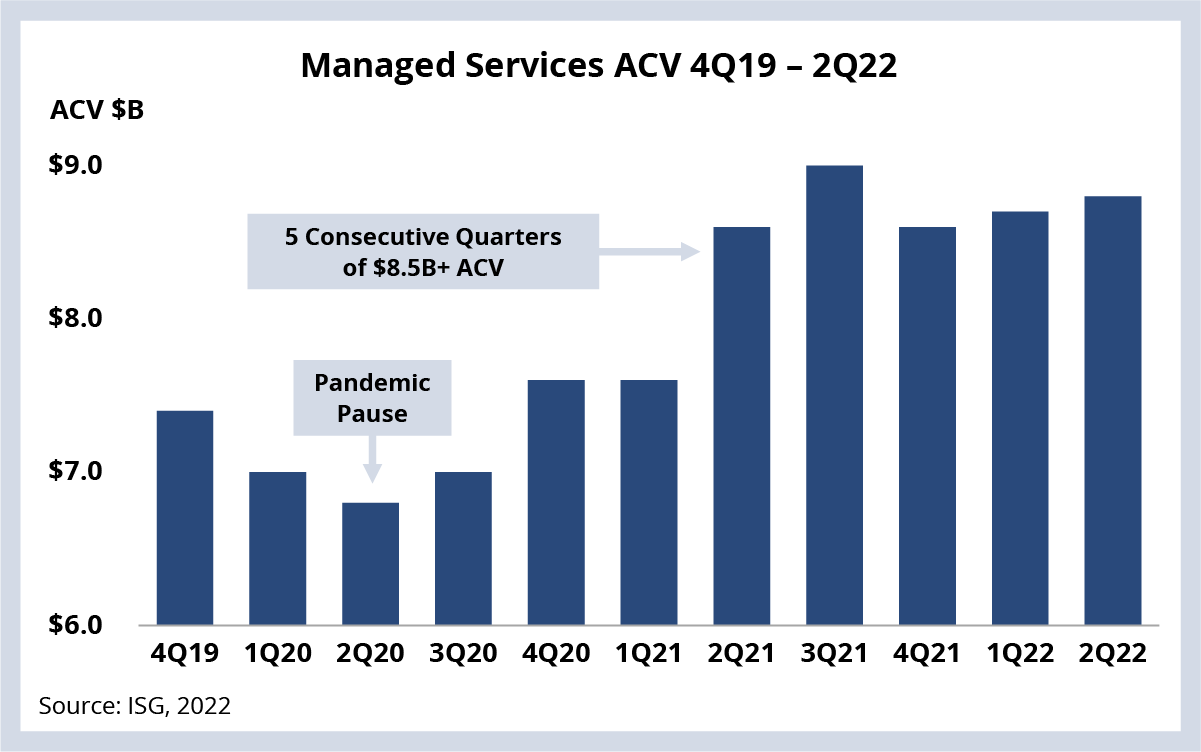

- Managed services has generated a record $8.5 billion of ACV for five consecutive quarters (see Data Watch).

- Prices for infrastructure resource units (e.g., servers, storage, etc.) are declining 2-4% Y/Y while applications and BPO prices are flat to slightly decreasing.

- Average annualized attrition is over 24%, still significantly elevated over pre-pandemic levels.

What’s Next:

Based on recent discussions and survey responses from ISG clients, we believe service providers can expect more cautious decision-making for IT services. Enterprises will seek faster time-to-value, and we believe we’ll see some significant reprioritization of capital spending over the next several quarters.

Cost optimization will also become a top priority in many industries. However, enterprises will need to recognize that savings will increasingly come from multi-year technology transformation and modernization initiatives, not necessarily from lower rates based on labor arbitrage.

And the strong U.S. dollar will continue to be a headwind for overall industry growth, especially for providers with a significant presence in EMEA or Asia Pacific.

I hope you can join us on the 3Q22 Index call next week when we’ll dig into these trends in more detail.

DATA WATCH

M&A

- Globant acquires Italian IT services firm Sysdata (link).

- French ER&D firm Alten acquires Romanian product engineering firm QUALITANCE (link).

- UST HealthProof acquiring healthcare BPO firm Advantasure (link).

- Accenture acquires Guidewire specialists Blackcomb Consultants (link).

- Capgemini acquiring German business intelligence firm Braincourt (link).