In addition to all the scientific infrastructure developed over the past decade, hyperscale clouds, super-fast connections to co-location data centers and massive new data processing capabilities have played a key part in this unprecedented drug development timeline.

Here’s what’s important in IT and business services this week:

Accenture is on a cloud acquisition spree

$40 billion in contract value up for renewal

Defining chatbot performance levels

Congressional committee examines SolarWinds breach

M&A SPOTLIGHT

Accenture is on a cloud M&A spree. Since the beginning of 2020, IT services giant Accenture has made 39 acquisitions, four times more than the two next-most-acquisitive IT services companies Atos and Cognizant. Accenture CEO Julie Sweet indicates the acquisitions will account for about 2 percent of Accenture’s 2021 revenue.

It's interesting to note that nearly half of the 39 acquisitions are in the U.S., 39 percent in EMEA, and 15 percent in Asia-Pacific, which is a breakdown that closely matches Accenture’s regional revenue distribution. According to the ISG M&A Database, nearly three quarters of the deals are valued at less than $50 million. Ten percent are valued at more than $200 million. And more than 40 percent of the acquisitions are cloud or cloud engineering related.

The SaaS acquisitions target specific high-growth platforms like Salesforce, ServiceNow and Workday. The cloud infrastructure acquisitions favor cloud native application development and full stack engineering. For example, in the last week alone, Accenture acquired two U.K.-based companies: Edenhouse, a mid-market SAP partner, and Infinity Works, a cloud and full stack engineering firm.

As we’ve discussed on previous Index calls and Insider briefings, growth in the as-a-service market, especially IaaS, is surging. We’re forecasting 20 percent growth for this segment in 2021, so it’s no surprise Accenture is focusing its acquisition factory on these targets.

DATA WATCH

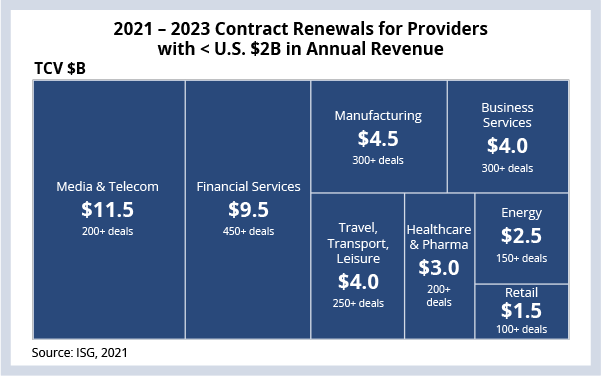

ISG is tracking a great deal of contract value coming to market over the next three years for providers with less than $2 billion in annual revenue. There are 155 providers with approximately $40 billion of total contract value (TCV) coming up for renewal across 2,000+ contracts and eight industry verticals.

PRACTITIONER'S POV

Human chat service level agreements are common in workplace services deals. Chatbot-specific SLAs not so much. Here are three points workplace services buyers should keep in mind when defining chatbot performance levels.

1) Chatbots are limited in the kinds of problems they can solve, so consider SLAs around intent recognition and containment. Did the bot understand what was being asked? And how many queries did it handle?

2) In situations in which the bot does not understand the intent and therefore does not contain the query, it will need to hand off the conversation to a human. Consider an SLA that measures the number of handoffs from chatbot to human.

3) Bot capabilities are increasing. Assuming they are trained to do so, intelligent agents can handle more complex requests, such as onboarding an employee, so keep track of new capabilities the bot successfully takes over from a human. New interactions and their success rate need to be evaluated differently than basic password reset requests. For example, you’ll want to use a sentiment score when measuring chat sessions with advanced intelligent agents.

DEAL ACTIVITY

Delta and IBM. U.S. airline expands existing relationship to focus on hybrid cloud transformation. Link

Telefónica and Wipro / Tech Mahindra. German telecommunications provider expands existing relationships; focus is on systems modernization. Link

National Bank of Canada, Accenture and nCino. Sixth largest commercial bank in Canada implements new core banking platform. Link

OP Financial Group and CGI. Finland's largest financial services group expands existing relationship with a focus on insurance operations. Link

Torc Robotics and Amazon. Daimler subsidiary picks AWS as preferred cloud provider for telemetry data and simulation. Link

Ingersoll Rand and Google. U.S. industrial equipment maker signs five-year agreement focused on connected devices. Link

Bosch and Microsoft. German engineering company building in-car software platform. Link

POLICY & SECURITY

Congressional committee examines SolarWinds breach. Livestreaming today. Link

AWS declines to participate in Senate Intelligence Committee hearing. Reports indicate that AWS was used to launch a key part of the SolarWinds attack. Link

Accellion breach spreads. Joint warning from cyber authorities in Australia, New Zealand, Singapore, U.K. and U.S. on vulnerabilities in file transfer appliance. Link

Executives plot path to net zero. Environmental, social and governance (ESG) criteria become increasingly important in service provider evaluations. Link