In this edition: As-a-service market share in EMEA is approaching 50%. HR-payroll globalization continues. Unisys-led consortium wins deal at EU agency. Zoom makes $14.7 billion bet on cloud contact center.

We had a fantastic response last week to the complimentary research note summarizing some of the Index inquiries, so we’re sharing another one. This note focuses on key considerations for sourcing cloud managed services – with a perspective for both enterprises and providers. Here’s the link to download it.

And as always, please send me your feedback at [email protected].

EMEA

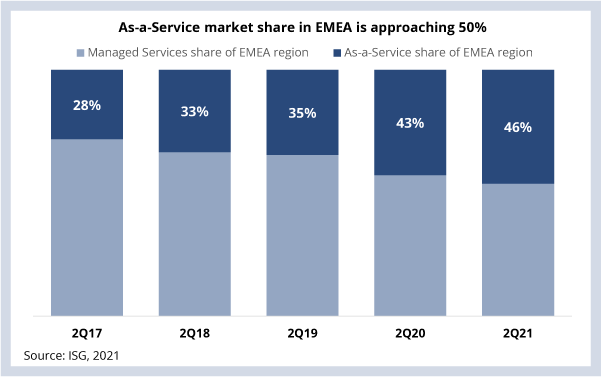

As-a-service market share in EMEA is approaching 50%. This is a huge change from just three years ago, when as-a-service market share in EMEA was less than 30% (see Data Watch). We’ve been waiting for it to break this way, and we believe this is a sustained trend. As-a-service is likely to become 50% of total annual contract value in EMEA by the end of the year, joining the Americas (62% of the market) and Asia Pacific (72% of the market).

Why it’s happening: European enterprises, especially in the U.K. and the Nordics, are increasingly embracing a cloud delivery model. This is partly due to the fact that cloud providers are building more local and regional data centers in Europe to reduce cross-border data transfers and address data privacy concerns. But it’s also a demand-side shift: European companies are increasingly using cloud to move faster and boost resiliency in response to the pandemic.

What it means: There is no digital without cloud, so our view is that this accelerated cloud adoption will significantly increase spending on digital transformation projects across EMEA in areas like DevOps, analytics, cybersecurity and digital engineering.

DATA WATCH

HUMAN CAPITAL MANAGEMENT

There is probably no one on the planet who knows the global payroll ecosystem better than my colleague Julie Fernandez. And the globalization of this market is one of the key themes she’s tracking. Per Julie, “HR-payroll globalization has been the result of a decade-long series of partner relationships and acquisitions, reading much like a tabloid for those who follow the power couples and broken hearts.” One of the most recent examples of this is HCM provider Ceridian signaling its intent to grow in Asia Pacific with its recent acquisitions of Excelity and Ascender.

You can read part one of Julie’s POV here and part two here.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

As we discussed on the 2Q21 Index call, we’re seeing enterprises increasingly incorporate their providers’ commitments to environmental and social good, as well as their corporate governance and risk practices, into their own IT services evaluations. One area that is gaining global attention – especially in Europe and Asia Pacific – is the elimination of modern slavery.

In June, Germany and Norway passed new modern slavery legislation. They joined the U.K., the Netherlands, France, Australia and California in the fight to eradicate human exploitation within companies’ supply chains. My colleagues Lois Coatney and Hanne McBlain are hosting a webinar on this important topic. It applies to both buyers and sellers of IT services - so I encourage you to register if you are in the Asia Pac region.

DEAL ACTIVITY

- eu-LISA and Unisys. European Union agency signs four-year IT services deal with Unisys-led consortium. Link

- HM Land Registry and Cyient. U.K. government digitizing 26 million land records. Link

- Centrica and WNS. British multinational energy company extends relationship with focus on customer experience. Link

- Bank Norwegian and TietoEVRY. Norwegian internet bank extends fraud prevention relationship into Germany and Spain. Link

M&A, ALLIANCES

- Zoom acquiring cloud contact center provider Five9 for $14.7 billion. Link

- Cognizant acquiring manufacturing data intelligence firm TQS Integration. Link

- Capgemini acquiring Australian digital services firm Empired (link) and expanding existing partnership with CONA Services (link).

- Accenture acquiring Canadian Oracle cloud specialist Cloudworks (link) and HCM advisory firm Workforce Insight (link).