In this edition: Engineering services is rising at 30% CAGR. Cyber insurance requirements becoming more stringent. Contact center consolidation continues. HCL wins at U.S. mining company and Microsoft acquires threat intelligence firm.

Also, I’m excited to announce that, for a limited time, we’re offering complimentary access to select ISG Index research notes. We publish a regular cadence of deeper-dive notes focused on one or more of the topics we cover in the Insider, so use this link to download your complimentary copy. And as always, please send me your feedback at [email protected].

ENGINEERING SERVICES

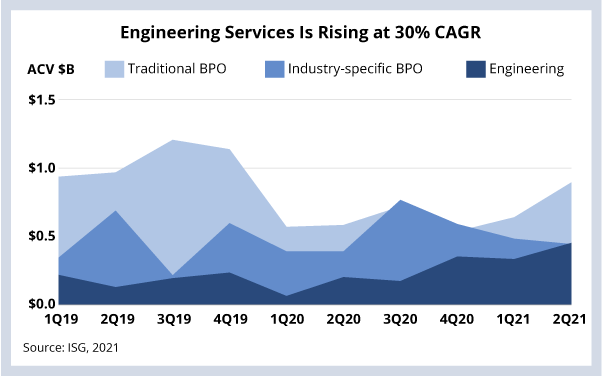

The engineering services market is growing 30% CAGR. The sector posted a record $742 million in ACV in the first half of 2021 (see Data Watch). While COVID impacted spending in the ER&D segment early in 2020, we believe the pandemic has actually led to an expansion of the total addressable engineering services market as companies in manufacturing, automotive, healthcare and energy look to increase resiliency and accelerate their digital transformation.

As a result, engineering services M&A is heating up. Accenture recently acquired 4,200 engineers in German firm umlaut, then added an additional 70 systems integration specialists with the acquisition of the consulting assets of Japanese firm DI Square. Those two add to the flurry of recent ER&D M&A including LTI’s acquisition of Cuelogic, Zensar’s acquisition of M3bi, and Cognizant’s acquisition of ESG Mobility.

DATA WATCH

CYBERSECURITY

The number of requirements to buy or renew cyber insurance is growing rapidly. Insurance providers are increasingly seeking proof that companies are hardening their defenses using common practices described in industry-standard frameworks (for example, the NIST cybersecurity framework). And get ready to fill out some very long forms when you buy or renew cyber insurance; what used to be ten questions on cyber has turn into several hundred. We’re also seeing insurance companies mandate very specific requirements like increased network segmentation and multi-factor authentication to qualify for a policy.

And it’s not just the front end of the process that is being impacted. As we discussed on the Index call last week, insurance firm AXA announced it will no longer reimburse customers for ransomware payments in France. This stance is likely to spill over into other firms and countries.

What this means: Expect to see a surge in demand for cybersecurity assessments and remediation over the next several quarters as companies harden their systems and processes in the face of an unprecedented number of breaches and ransomware attacks. Also expect to see the torrid pace of cybersecurity M&A continue as the IT services sector looks to capitalize on demand for managed security services – and as providers look to ensure they themselves are not victims of growing software-based supply chain attacks.

CONTACT CENTER

Contact center was hit hard during the pandemic, but it is recovering: 1H21 ACV was up 30% Y/Y. What didn’t change was the continued consolidation of this sector. Sitel recently announced it was acquiring SYKES, which follows the pattern of large-scale and strategic acquisitions in the same vein as Concentrix-Convergys, Teleperformance-Intelenet, Startek-Aegis and Infosys-Eishtec. My colleagues Mrinal Rai and Namratha Dharshan recently wrote about this trend here.

COMMERCIAL SECTOR DEAL ACTIVITY

- The Mosaic Company and HCL. U.S. mining company signs five-year apps-and-infrastructure deal. Link

- Casino Group, Google and Accenture. French retailer improving B2B and B2C analytics. Link

- CIBC and Microsoft. Canadian bank selects its primary cloud platform. Link

PUBLIC SECTOR DEAL ACTIVITY

- Services Australia and Hitachi Vantara. $35 million hardware + services deal. Link

- NSW Parliament and DXC. Five-year modernization deal. Link

- BBK and Sopra Steria. German civil protection office refactors for cloud. Link

- Dutch Ministry of Defense, Atos and IBM. Armed forces department building new infrastructure. Link

M&A, ALLIANCES

- Microsoft acquiring threat intelligence and attack surface management firm RiskIQ. Link

- IBM acquires Spanish data analytics firm Bluetab. Link

- Accenture acquires DACH Google Cloud specialist Wabion. Link

- HPE expanding cloud data management and analytics capabilities with Zerto (link) and Ampool (link).

- Tech Mahindra ramping up MSSP services with Palo Alto Networks (link) and TAC partnerships (link).