Was this email forwarded to you? Sign up here to get the Index Insider every Friday.

Here's what's important in IT and business services this week:

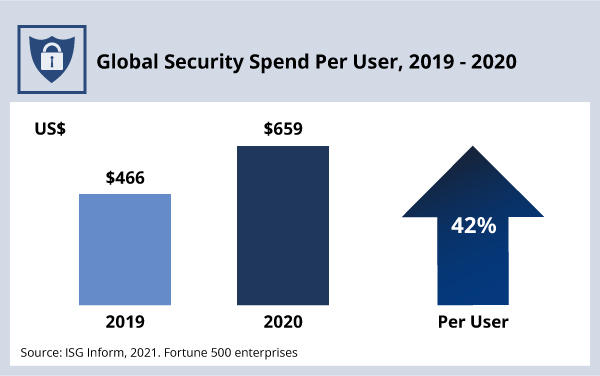

- Enterprise security spending is up by more than 40 percent

- Microsoft’s acquisition of Nuance is about more than healthcare

- World’s largest steel producer signs multi-year ADM and BPM deal

SECURITY

Enterprise security spending per user increased by more than 40 percent between 2019 and 2020 (see Data Watch) – and is likely to increase again in 2021. Nearly three quarters of ISG advisors said their clients plan to increase their security spend this year – and this was before the unprecedented SolarWinds and Exchange breaches in the first quarter.

It’s not just external threats that are driving increased demand for security solutions and services. The combination of legacy technology and an explosion of internet-facing devices and services is generating technical complexity, which leads to configuration errors. Configuration errors caused by humans - which is now one of the leading causes for breaches.

The IT services market is responding – some by organically building next-generation cyber services, and some by acquiring it. Just in the first quarter, Atos acquired Motiv ICT and In Fidem, Deloitte acquired R9B, and Wipro acquired Ampion. Expect to see a lot more M&A in this space this quarter.

DATA WATCH

MICROSOFT

Microsoft announced its second-largest acquisition ever this week. Here’s my colleague Blair Hanley Frank on the news:

Microsoft announced this week its plans to acquire Nuance, a pioneer in voice recognition and natural language understanding. A press release from Microsoft made clear the $19.7 billion acquisition was to bolster its ambitions in the healthcare market, but it falls short of giving a satisfying explanation for the hefty purchase price.

Nuance’s expertise in machine learning means it is a natural fit for the tech giant’s expansive research organization. Microsoft also will likely leverage Nuance’s existing suite of machine learning products and treasure trove of training data to enhance its language-understanding product portfolio.

Since several Nuance services already use Azure as their underlying cloud platform, Microsoft may be able to encourage customers of those services to use more of its cloud services as a result of the deal. Microsoft’s sales organization will almost certainly drive additional adoption of Nuance’s existing services, beyond what the company was capable of independently.

It will likely take months, if not years, after the close of the acquisition for these benefits to manifest in Microsoft’s overall product portfolio. In the near term, the deal will likely help Microsoft pitch enterprise customers on its forthcoming healthcare-focused public cloud offering.

Finish reading Blair’s POV here.

DEAL ACTIVITY

- ArcelorMittal and Infosys. World’s largest steel producer signs ADM and BPM deal. Link

- Bharat Petroleum and Accenture. India’s second-largest oil marketer transforming its sales and distribution network. Link

- Associated British Ports and Verizon. U.K. port operator signs first private 5G deal in Europe. Link

- Grupo Globo and Google Cloud. Latin America’s largest media conglomerate will migrate all data centers to GCP. Link

- Ericsson and TCS. Swedish communications giant transforming its R&D environment. Link

- Singapore Airlines, Salesforce and Capgemini. Airline creating new customer case management system. Link

M&A

- Private equity firm KKR acquires Ensono. Link

- Dell spins out VMware to create two standalone public companies. Link

- IBM acquires Italian process mining firm myInvenio. Link

- Coforge (formerly NIIT) acquires 60 percent stake in BPM firm SLK. Link

- Logicalis acquires Spanish cybersecurity firm Áudea. Link

- Options Technology acquires front-office trading services business from DXC. Link

- Dedalus Group acquires healthcare software business from DXC. Link

- Endava acquires payments, logistics and media services firm Levvel. Link

- Fujitsu Australia acquires data analytics firm Versor. Link