As we approach our 17th annual service provider and enterprise sourcing events, we’re taking a look back at the last four years to understand how the pandemic fundamentally changed – and in some cases didn’t change – the IT services sector. We hope you can join us for one of these fantastic events.

INDUSTRY CHECKPOINT

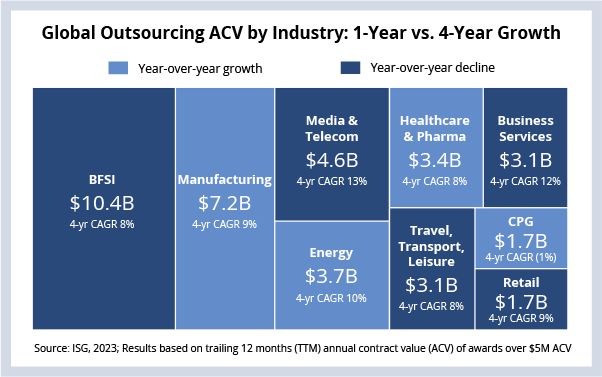

Of the nine industries we track, four of them drove the record-setting managed services results in the second quarter, while the other five declined year over year. But, if we look back to 2019, we see eight of nine industries saw growth well above historical levels.

DATA WATCH

Background

There have been a lot of highs and lows in our sector over the past four years. From the pandemic-driven decline in 2020 to the post-pandemic demand explosion of 2021 - 2022. It’s easy to get caught up in all the ups and downs, especially as things start to cool down, as they are now.

A wider lens can give us a better perspective. Did these big swings result in big shifts in the IT services sector? Or are we just back to pre-pandemic norms? We looked at the bigger picture last week when we looked at the supply side – another area that has seen massive swings over the past 48 months.

So, this week we’re taking a look at outsourcing demand by industry with a one-year and four-year view.

The Details

- Eight out of nine industries have seen a compound annual growth rate of 8% or more over the past four years, with only Consumer Goods declining. This means the outsourcing “pie” is significantly bigger now than it was before the pandemic.

- On a trailing 12-month basis, five of nine industries saw year-over-year ACV decline. This means that industries representing almost 60% of the ACV globally are smaller than a year ago.

- The four industry segments that did grow in the past year – Manufacturing, Energy, Healthcare and Consumer Goods – all saw robust double-digit growth.

What's Next

Outsourcing activity in each industry responded differently to the pandemic – and to the recent macroeconomic slowdown. Some industries, like Healthcare and Media and Telecom, saw bigger positive and negative swings when compared to industries like Manufacturing and Energy.

These swings impact providers in different ways. Some providers are heavily concentrated in a few industries, while others are more evenly distributed. Obviously, many providers with greater exposure to the five industries that declined in the last 12 months have seen their growth slow down, but they also benefited when these industries were growing.

And it’s important to keep in mind the recent slowdown in discretionary technology spending, which cuts across all industries. This macro-driven trend is having an outsized impact on providers that 1) are heavily focused on project-based work and 2) have clients that are sensitive to discretionary consumer spending.

Looking ahead, we’re continuing to forecast 5% growth for managed services with varying growth by industry. A focus on cost optimization will continue to be a common thread across industries, as will a focus on renewing and extending existing relationships.

Let me know if you’re interested in learning more about these trends – as well as what our industry forecast for the rest of the year looks like. And Sunder and I hope you can join us in Dallas at the Sourcing Industry Conference on September 11 or at SourceIT on September 14 to talk about these trends in more detail.