If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

ENGINEERING

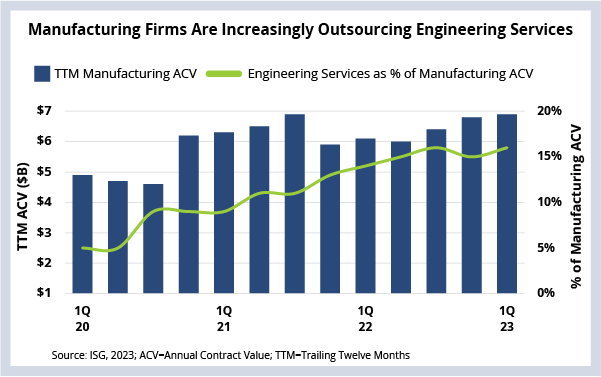

Manufacturing firms are increasing their use of outsourced engineering services as they make the shift from disconnected products to connected customer experiences.

DATA WATCH

As we discussed at our Smart Manufacturing event in Chicago last week, we’re seeing a massive shift in the manufacturing sector away from standalone products and toward connected experiences.

Firms are starting to stitch together people, processes and data across areas like design, manufacturing, distribution and aftermarket support. This is known as the “digital thread.” This new approach is forcing manufacturing leaders to move from IT-centric operating models based on traditional IT infrastructure and ERP systems to a model that requires new skills and approaches.

And this, in turn, has significantly increased demand for outsourced engineering services in areas like product design and development, customer experiences (e.g., aftermarket services), intelligent factory operations and, of course, platforms and applications modernization and support.

The Details

- Engineering ACV is up 36% Y/Y and up 90% on its five-year average.

- As a percentage of manufacturing ACV, engineering is up from 7% in 2019 to 16% in 2023.

- 75% of manufacturing firms plan to maintain or increase their investment in AI and machine-to-machine communications technology over the next 24 months.

Big Opportunity Meets Big Challenges

And while we see a significant increase in demand for engineering services, it’s important to remember there are – and will continue to be – several challenges for manufacturing firms as they make the pivot from being providers of products to providers of connected experiences.

Organizational change – or better yet, the inability to change – continues to be the number one factor holding manufacturing firms back from taking advantage of this immense opportunity.

And there is a supply-side challenge as well. As we discussed a few months ago, most engineering spend today is internal through captive centers in lower-cost locations with lots of engineering talent (like India and Eastern Europe). These centers are feeling immense pressure to keep pace with fast-moving service provider peers in a tight labor market.

To address this talent crunch, manufacturing firms are going to rely on service providers for help – and in turn, providers are going to continue to consolidate to gain scale. This consolidation is actually what manufacturing enterprises are seeking in their provider relationships.

I hope you can join Steve, Kathy, Namratha and me on the 2Q23 Index Call on July 13, when we’ll talk in more detail about the key changes in demand, delivery and pricing we’re seeing in this sector this quarter.