If someone forwarded you this briefing, consider subscribing here.

EMEA

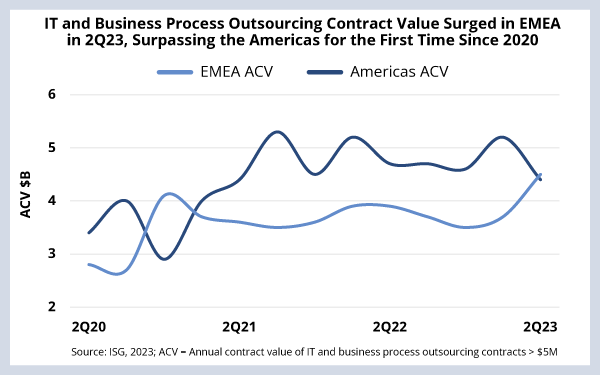

IT and business process outsourcing contract value surged in EMEA in 2Q23, surpassing the Americas for the first time since 2020.

DATA WATCH

Background

As we recently discussed on the 2Q23 Index Call (PDF), the IT and business services industry generated over $10 billion of managed services annual contract value for the first time ever. And much of that record setting growth came from the EMEA region. European enterprises were laser focused on cost optimization in the second quarter, in response to high inflation and elevated energy costs, which continue to put pressure on consumer spending.

The lion’s share of this cost-optimization led bookings growth came from the UK and DACH regions, and from five mega awards.

The Details

- EMEA annual contract value of $4.5 billion was up 15% Y/Y

- The UK region was up 50% Y/Y, and the DACH region was up 16% Y/Y

- There were five mega awards in the second quarter, with a combined value of over $1 billion

What’s Next

This is only the second time since the second quarter of 2020 that EMEA generated more IT services contract value than the Americas, so it’s an important inflection point in the industry.

However, there were really two factors that led to this. First, the five mega awards. The EMEA region averages around three mega awards each quarter, so five is a lot. In fact, it’s the most since the second quarter of 2022.

Second, ACV in the Americas was down almost 7% Y/Y. But that decline was almost exclusively due to weakness in the banking sector, which was down 21% Y/Y.

So, what does this mean for the IT and business services sector in EMEA in the second half of 2023? We’re continuing to see strong demand and solid pipelines, but it’s important to remember that the third quarter in EMEA is typically soft, given the summer holiday season.

However, it’s our view that Europe should continue to outpace global growth, which is one of the primary reasons that we’re holding our global market forecast at 5%.