In this edition: Managed services M&A surges as providers search for growth. Canadian communications firm extends ITO agreement. ServiceNow wants to map the workplace. HGS is selling its healthcare business.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

M&A

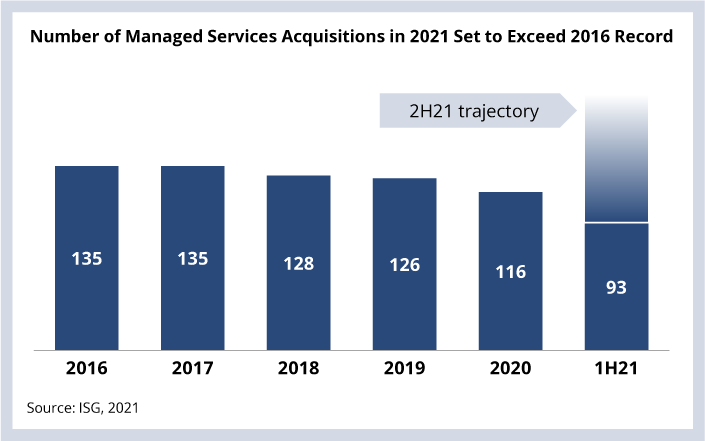

There were 93 managed services acquisitions in 1H21, which is on pace to set a record for M&A activity for the full year (see Data Watch). Accenture, IBM, Tech Mahindra, Atos, Cognizant and EPAM have been the most acquisitive IT services providers through the first half of the year.

Providers are using sub $50 million valuation acquisitions as a lever to quickly enter high-growth areas like cloud, engineering and security and to land and expand into new geographies. Talent is extremely tight right now – especially in India – so M&A is one of several levers providers can use to gain access to this talent (as well as the clients and regions they serve). If you’ve attended recent provider earnings calls, you’ve undoubtedly heard them flag access to talent as a risk – both for topline growth and for margins.

But this surge in M&A activity also creates anxiety for enterprise leaders who are engaged with these firms – especially smaller, regional boutique firms that are acquired by much larger firms. Transparency – and overcommunication – are critical from both the acquirer and the acquired.

Interested in more? Here’s another complimentary Index Research Note for a deeper dive on this topic (link). And as usual, send me your questions or feedback at [email protected].

DATA WATCH

LOCATION TECHNOLOGY

ServiceNow is acquiring French indoor mapping and wayfinding firm Mapwize (link). To understand why, I turned to my colleague Ron Exler – who has covered the indoor mapping space for a long time. Here’s Ron’s POV:

If ServiceNow wants to know where people are at work, it needs a decent map foundation. It's relatively easy to get to street-address-level granularity with GPS-based systems like Google Maps, but the signal fades inside to the point of being unusable. Unlike street maps, Google, Apple and Microsoft mapping capabilities don’t directly provide views or navigation of office spaces, focusing instead on map views of public and high-traffic venues such as airports and stadiums.

Mapwize gives ServiceNow an indoor navigation capability with straightforward map creation, which could be used to create inventory maps for IT assets. This is valuable given the rapid switch to “hot desks” and shared conference rooms, and it potentially helps HR and facilities leaders understand where people are in their attempts to enforce COVID distancing. ServiceNow seeks to expand, and location data is needed for other Internet of Things applications. We expect M&A activity of indoor mapping companies to continue.

DEAL ACTIVITY

- Rogers and HCL. Canadian communications giant extends multi-year ITO agreement (link).

- Department of Veterans Affairs and Peraton. U.S. agency signs seven-year $497 million infrastructure managed services agreement (link).

- Argonne National Laboratory and NTT DATA. Largest laboratory in the U.S. Midwest signs workplace services deal (link).

- PureGym and Ceridian. Largest health club operator in the U.K. selects Dayforce (link).

- Aramex and Salesforce. Multinational logistics company goes live with CRM (link).

M&A

- HGS selling its healthcare business to Barings private equity for $1.2 billion (link).

- EPAM expands LATAM presence with Colombian software engineering firm S4N (link).

- ServiceNow acquires PostgreSQL database performance firm Swarm64 (link).

- Appian rounds out low-code automation suite with acquisition of process mining firm Lana Labs (link).

- Kofax acquires print management SaaS provider Printix (link).

- NICE acquires digital customer guidance firm GoMoxie (link).