If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

M&A

L&T announced today the merger of LTI and Mindtree. The new $3.5 billion combined entity will be called LTIMindtree. My colleague Mrinal Rai will have more on this next week, but, in our point of view, the timing is right for this merger.

LTI and Mindtree have strong synergies across industries and service lines. Still, there will be a lot of work ahead for both firms to create these synergies – and to help clients and prospects understand them given the historical confusion around the L&T, LTI and Mindtree relationship.

LTI and Mindtree have strong synergies across industries and service lines. Still, there will be a lot of work ahead for both firms to create these synergies – and to help clients and prospects understand them given the historical confusion around the L&T, LTI and Mindtree relationship.

INFRASTRUCTURE-AS-A-SERVICE

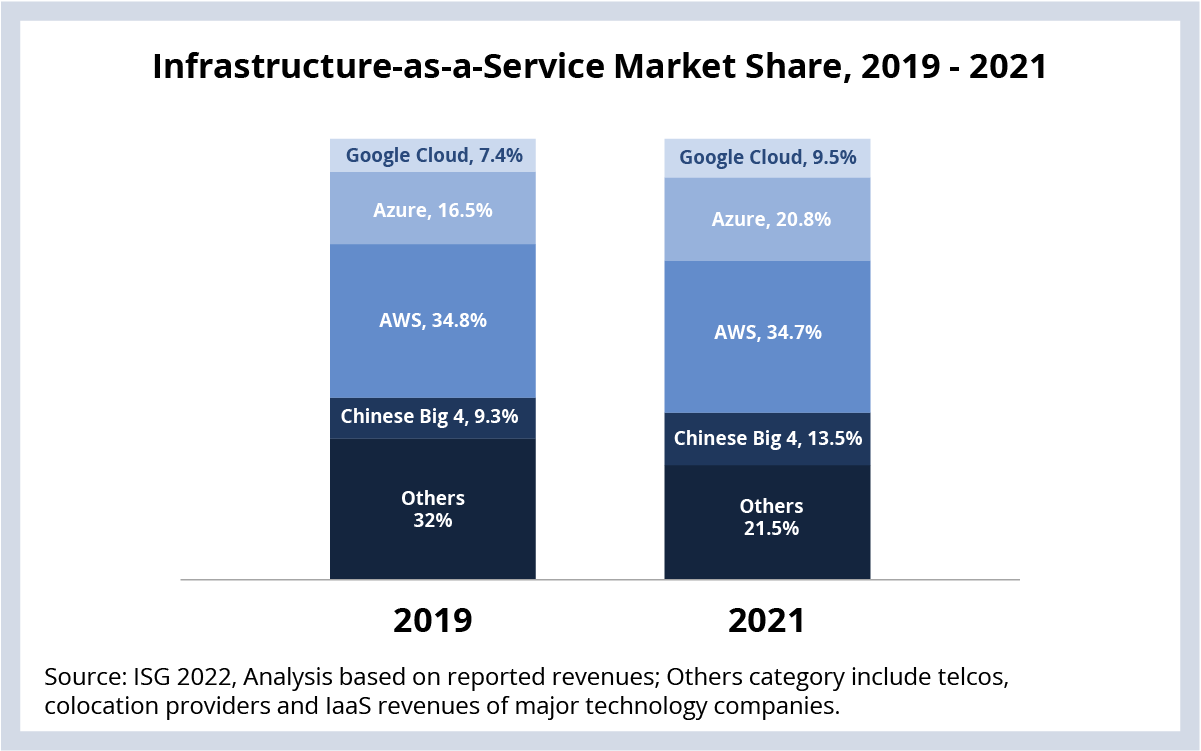

Microsoft and Google’s IaaS market share increased significantly over the past 24 months. Between 2019 and 2021, Azure’s market share increased from 16.5% to 20.8%. Google Cloud’s share increased from 7.4% to 9.5%. During that same period, market share for AWS – the market leader – stayed flat at just under 35% (see Data Watch).

We’ve talked at length about the post-pandemic surge in cloud adoption and the fact that the big three U.S. hyperscalers are the beneficiaries. Revenues grew across the board in 2021: AWS’s by 37%, Google’s by nearly 48% and Microsoft’s by 49%. While AWS has led the field, Azure and Google are catching up. You can see this reflected in their backlogs as well. In the first quarter, Microsoft’s backlog was up over 30%, and Google’s was up 70%.

Given that we’re moving into the “heavy lifting” phase of cloud, a lot of legacy enterprise workloads are getting moved. Last week, we talked about how these workloads are moving – most often with minimal architectural changes. In many ways that favors Azure.

That’s because of Microsoft’s strong enterprise penetration. Remember that Azure is not Microsoft’s only cloud service – Office 365 and Dynamics also have massive installations. This creates a strong linkage between Microsoft’s SaaS applications and its infrastructure cloud – a natural “next step” for enterprise IT organizations.

For Google, recent growth is due to a number of factors: a big push into the enterprise, especially in the banking sector, a strong commitment to open source, and (for now) a commitment to avoid competing with clients and partners.

AWS is still the IaaS leader. Its position is very strong as it continues to build out services that help enterprises move workloads on to its platform. That said, Microsoft is making strong inroads in Europe, and Google Cloud is making inroads in the banking and telecommunication sectors, both of which will likely chip away at AWS’ lead over time.

Either way the market share shifts, there is still a lot of room for growth for all three. There is a mountain of enterprise workloads that need be refactored or rebuilt to work on the cloud. This is creating vibrant service provider ecosystems as we are profiling in respective ISG Provider Lens studies for AWS, Azure and Google Cloud. While the big three hyperscalers have fundamentally changed the way IT works, enterprises are going to need a lot of help over the coming years moving – and exploiting – these industry-changing platforms.

We’ve talked at length about the post-pandemic surge in cloud adoption and the fact that the big three U.S. hyperscalers are the beneficiaries. Revenues grew across the board in 2021: AWS’s by 37%, Google’s by nearly 48% and Microsoft’s by 49%. While AWS has led the field, Azure and Google are catching up. You can see this reflected in their backlogs as well. In the first quarter, Microsoft’s backlog was up over 30%, and Google’s was up 70%.

Given that we’re moving into the “heavy lifting” phase of cloud, a lot of legacy enterprise workloads are getting moved. Last week, we talked about how these workloads are moving – most often with minimal architectural changes. In many ways that favors Azure.

That’s because of Microsoft’s strong enterprise penetration. Remember that Azure is not Microsoft’s only cloud service – Office 365 and Dynamics also have massive installations. This creates a strong linkage between Microsoft’s SaaS applications and its infrastructure cloud – a natural “next step” for enterprise IT organizations.

For Google, recent growth is due to a number of factors: a big push into the enterprise, especially in the banking sector, a strong commitment to open source, and (for now) a commitment to avoid competing with clients and partners.

AWS is still the IaaS leader. Its position is very strong as it continues to build out services that help enterprises move workloads on to its platform. That said, Microsoft is making strong inroads in Europe, and Google Cloud is making inroads in the banking and telecommunication sectors, both of which will likely chip away at AWS’ lead over time.

Either way the market share shifts, there is still a lot of room for growth for all three. There is a mountain of enterprise workloads that need be refactored or rebuilt to work on the cloud. This is creating vibrant service provider ecosystems as we are profiling in respective ISG Provider Lens studies for AWS, Azure and Google Cloud. While the big three hyperscalers have fundamentally changed the way IT works, enterprises are going to need a lot of help over the coming years moving – and exploiting – these industry-changing platforms.

DATA WATCH