Don't forget you can now access select ISG Index™ research for free. This includes presentations and Q&As from previous Index calls, provider leaderboards and Index Insider archives. Head over to the Index site here and click the “register” button if you are new to the site.

If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

PROCUREMENT

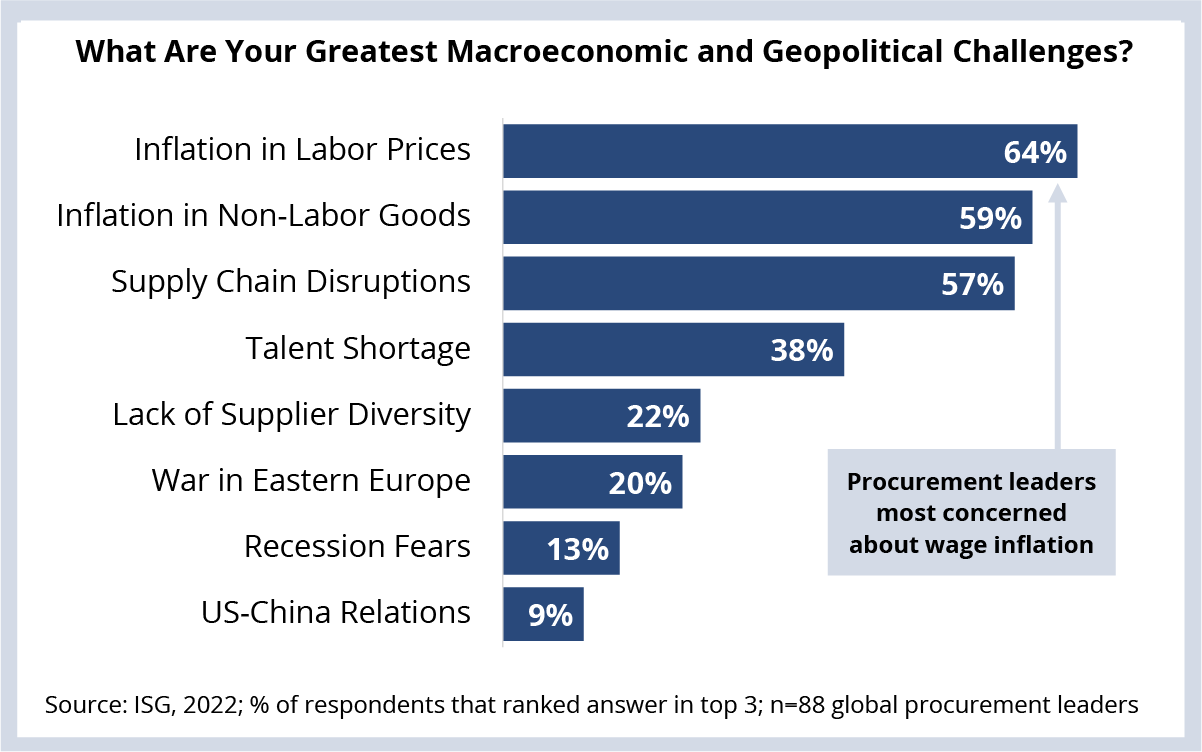

Wage inflation is the top concern for procurement leaders.

Background: ISG recently surveyed procurement leaders to understand how current macroeconomic and geopolitical pressures are impacting their buying decisions. Wage inflation was the primary concern.

The Details:

- 64% of procurement leaders ranked wage inflation as one of their top three challenges.

- Over 30% ranked wage inflation as their top macroeconomic challenge.

Why It Matters:

Technology wages have risen sharply over the past 12 months, especially in India. The rise is most acute for in-demand roles like cloud engineers, full-stack developers and cybersecurity architects.

Wage increases can (sometimes) lead to sharp price increases in IT services. As we’ve discussed, we see this happening today in project-based work where rates are up 15% in some cases. However, we don’t see increases in unit rates for managed services contracts – even given recent wage pressure.

While declining prices for outsourcing services – in the face of a period of high inflation – can be hugely beneficial to enterprises in the short run, they can be detrimental in the long run if the provider is not able to continually drive productivity improvements to maintain acceptable margins. A low or negative profitability relationship is bad for both the provider and the enterprise client.

What’s Next:

The shortage of skills for in-demand areas will persist as companies make technology modernization central to their strategy. In response, we will see service providers increasing their focus on grooming future delivery talent to reduce dependence on subcontractors (which can be as much as 30% more expensive than employees) and just-in-time hiring to meet short-term demand.

So, while wage inflation in the context of the IT services sector is a significant concern for procurement leaders, the real implication here is the impact that wage inflation has on service quality. Providers that can build, rather than buy talent and drive productivity improvements into their work will be better able to absorb future wage increases. This will help keep service quality at the contracted-for levels.

DATA WATCH

M&A

- Claranet acquires French IT services firm Pictime Group, German Microsoft specialist AddOn and Italian AWS specialist Flowing (link).

- NTT Data acquiring MuleSoft services firm Apisero (link).

- Sutherland acquires contact center agent guidance platform Augment CXM (link).

- Cybersecurity firm CrowdStrike acquires attack surface management vendor Reposify (link).

- IBM acquiring product engineering consulting firm Dialexa (link).