In this edition: SaaS revenues are accelerating after a pandemic pause. Third busiest airport in Europe signs five-year workplace services deal with Capgemini. American Tower is acquiring colocation firm CoreSite for $10.1 billion.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

SOFTWARE-AS-A-SERVICE

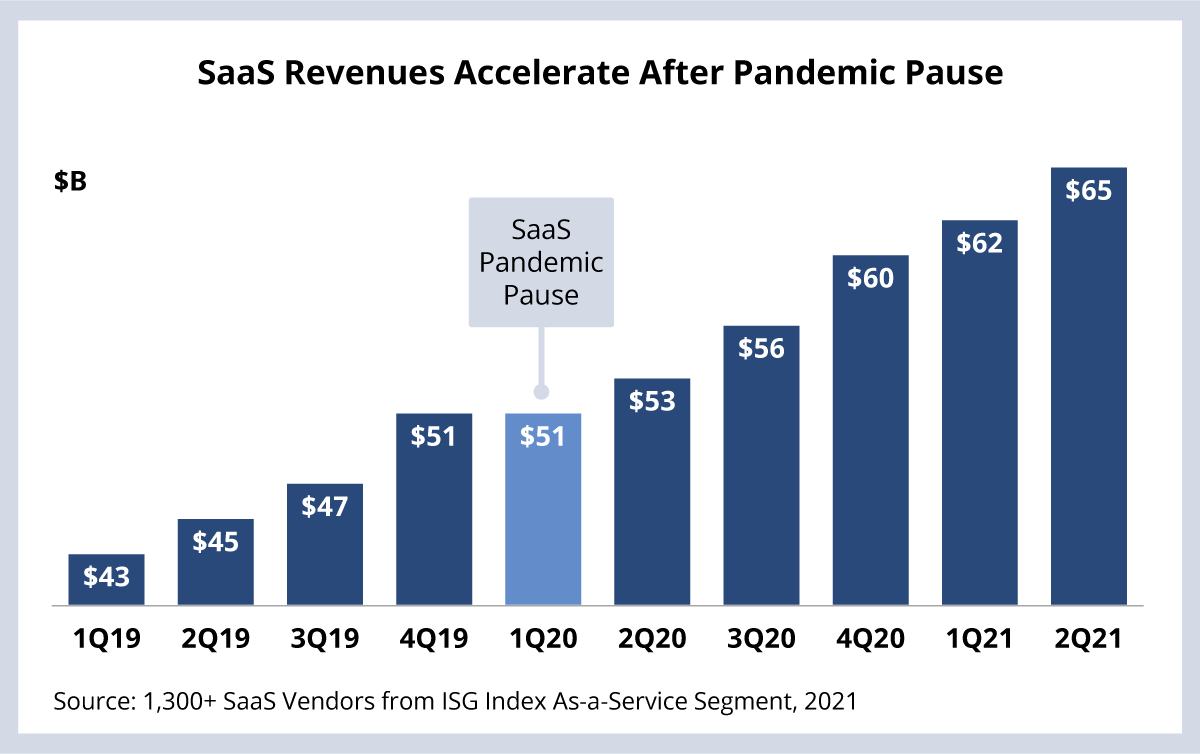

SaaS revenues are accelerating after taking a pause during the pandemic. During the initial months of the pandemic, we saw a slowdown in software-as-a-service spending. Case in point: SaaS revenue growth slowed to an average of 2.2% Q/Q during the COVID-impacted quarters of 2020.

SaaS implementations for core functions like Finance, HR, CRM and ITSM are not trivial exercises. Just like any big corporate change, they require time, focus and cash to pay licensing fees and for systems integrators to implement the new system. All things that were in short supply during the early stages of the pandemic when discretionary technology spending plummeted.

But it only took a few weeks for companies to recognize they were going to need to work remotely, build resiliency into their operations and, eventually, be able to capitalize on the vaccine-fueled growth surge. And these are things a well-implemented SaaS system can help make happen.

Take a look at the Data Watch section below. SaaS revenues are booming again as enterprises turbocharge their investments in SaaS – and the related work to get these systems implemented. We believe this strong growth will continue, which is one of the key reasons we increased our full-year as-a-service growth forecast to 25%.

DATA WATCH

DEAL ACTIVITY

M&A ACTIVITY

- Global REIT American Tower acquiring colocation provider CoreSite for $10.1 billion (link).

- Cloud banking provider nCino acquiring digital mortgage startup SimpleNexus for $1.2 billion (link).

- Accenture acquiring Japanese e-commerce firm Tambourine (link), asset performance management consultancy T.A. Cook (link) and U.K.-based strategy consulting firm Founders Intelligence (link).

- Unisys acquiring European endpoint management firm Mobinergy (link).

- Tech Mahindra acquires digital engineering provider Lodestone (link).

- Globant acquiring Salesforce specialist Navint (link).