If someone forwarded you this briefing, consider subscribing here.

TRANSITION

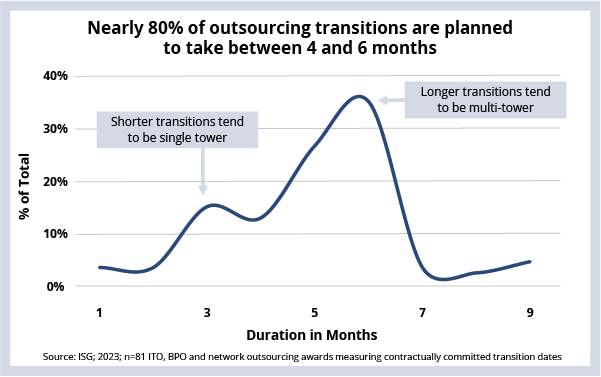

Nearly 80% of outsourcing transitions are planned to take between four and six months. While providers have streamlined methodologies and introduced technology to accelerate transitions, the time to execute has stayed relatively flat as enterprise complexity increases.

DATA WATCH

Background

As the link between sales and delivery, outsourcing transitions are critical. Enterprise buyers want to get to value as soon as possible, while service providers want to generate revenue as soon as possible. Neither can happen without transition.

Given this, there is a tendency from both sides to try to fast-track transition. However, this can create risks. Enterprises often underestimate the transition time commitment and overestimate how well documented the work to be outsourced needs to be.

And given the pressure to win in a highly competitive industry, providers often underestimate the complexity of the environment. This will of course lead to longer timelines and / or margin pressure, depending on how the provider decides to address the problem.

What's Next

Given that both sides want to get to value faster, the question remains: can transitions go faster? The answer depends.

Providers are increasingly inserting technology into the transition phase itself, and not just the run phase. For example, in infrastructure outsourcing, providers have systems that can learn how the infrastructure works and identify correlations to reduce problems. And in BPO, providers are using technology to capture everything from keystrokes to voices, in order to speed up knowledge transfer. Look for generative AI to start to play a role here, especially in areas where a lot of documentation needs to be summarized quickly.

But as providers make these investments to get to value faster, it is important to remember there is no free lunch. Transitions are investments. They are paid for up front (usually as a set of milestone payments) or the cost is bundled into the run costs. We do see enterprise buyers often wanting to spread these costs out over the term of the deal, but again, there is no free lunch. It will cost more to terminate the relationship in the future.

No matter how the transition is paid for, it still takes time. And on the whole, the time transitions take has not changed significantly over the past several years. While technology has helped to accelerate the process, technical debt combined with increased process complexity means that we’re unlikely to see deal sizes get much shorter, because it’s after transition that providers make their money.

Reminder that the 2Q23 Index Call is only three weeks away. Join Steve, Kathy, Namratha and me on July 13 at 9:00 AM ET as we take your questions on the health and growth of the industry.